Executive Summary

- Rising labor costs, payer reimbursement pressures, and provider shortages are accelerating the need for strategic monetization to preserve operational viability.

- Models like EBPC (Earnings Before Physician Compensation) are becoming more popular than conventional valuation methods, as they create better-aligned incentives for providers.

- Private equity and strategic buyers are increasingly favoring scalable platforms over tuck-in acquisitions, driving premium valuations for integrated behavioral health groups.

- Timing is critical; early movers in monetization can command higher valuations and more favorable partnership terms amid ongoing market consolidation.

- Independent groups must proactively assess their equity strategy to remain competitive, attract capital, and navigate the evolving behavioral health landscape.

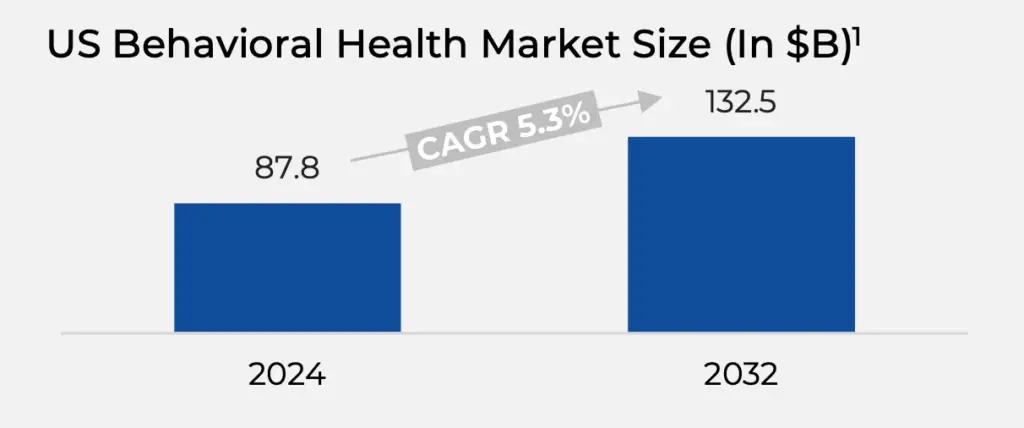

Behavioral Health Market Context

In 2024, approximately 60 million US adults (23.08% of all US adults) had a mental illness, and more than 122 million people live in a mental health workforce shortage area.2

Serious mental illness costs America $193.2B in lost earning every year.3

2.4 million US adults live with schizophrenia3

6.1 million US adults have bipolar disorder3

16.0 million US adults have major depression3

42.0 million US adults have anxiety disorders3

Macro Trends

The Consolidation Landscape

As hospitals, insurers, and private equity funds increasingly consolidate into larger systems, independent provider groups in the behavioral health segment in the US are facing continually rising competition. Studies indicate that with rising consolidation, these independent firms receive lower reimbursements and face tougher negotiations.

Technology and Infrastructure Investment Needs

To keep pace with the rapidly evolving landscape, adoption of telehealth and digital behavioral health tools has accelerated, driven by advances in technology platforms. Independent groups need to think about monetization to stay competitive with larger organizations.

1. Fortune Business Insights 2. MHA 3. NAMI

Market Context & Strategic Imperative

Workforce Shortages

The behavioral health sector is grappling with a critical and unsustainable provider shortage. As of August 2024, over 122 million Americans live in areas with insufficient access to mental health professionals. This is leading to insufficient coverage as well as rising costs in the sector due to scarcity of skilled personnel. To address the current demand, the system needs more than 8,000 additional clinicians.1

This gap is not just a workforce issue; it is a strategic threat. Without proactive intervention, the escalating cost of health benefits will continue to strain provider budgets, jeopardizing access, quality, and long-term viability. Monetization equips independent groups with the financial strength to invest in long-term strategies.

Growing Awareness for Mental Health

According to the CDC, the number of adults who reported adverse childhood experiences (ACEs) has increased, highlighting the growing awareness and destigmatization of mental health issues.

Shift to Value-Based Payment Models

There is a growing emphasis on value-based care, which requires providers to meet stringent quality metrics and outcomes. While these models incentivize a focus on patient outcomes and overall well-being, they can be costly and complex for smaller groups to implement and manage. Recent data shows that 93.5 million Americans are in an Accountable Care Organization (ACO) arrangement, and 73% of payers believe that alternative payment models will continue to rise, further pushing the industry towards value-based care.4

1. HRSA 2. CDC 3. MHA 4. AMA

As larger groups consolidate and invest in technology and talent, independent practices that don’t pursue monetization risk being left behind. Partnering strategically is no longer optional; it’s becoming essential to stay competitive and thrive in this industry.

Why Independent Providers Are Monetizing Now

- Payers are steadily reducing reimbursement for many procedures and office visits, particularly in primary care and routine specialties.

- Staffing costs have surged, with shortages driving up salaries for physicians, nurses, and support staff.

- Administrative burden related to compliance, reporting, and billing has increased overhead, requiring more back-office resources.

- Patients are increasingly funneled into system-owned networks through insurance design, marketing, and care coordination, reducing patient flow to independents behavioral health groups.

Structuring the Shift & Capturing Value

Monetization Structures: Earnings Before Physician Compensation (EBPC)

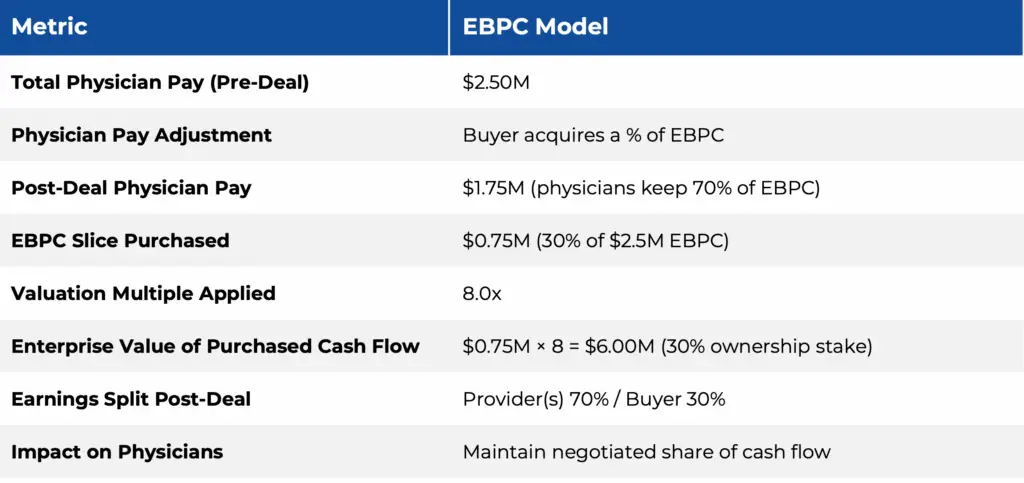

Physician practice transactions are often structured around valuation and compensation frameworks, with a key focus on the EBPC model. Consider a simple case study of a five-doctor behavioral health group with $7.50M revenue, $5.00M in operating expenses, and thus $2.50M in EBPC.

While certain deal structures may warrant alternative calculations, this represents the prevailing buyer standard.

Strategic vs. Financial: Tailoring Your Deal

Industry data show roughly 80% of recent behavioral health M&A are follow-on (tuck-in) acquisitions rather than first-time platform buys. Private equity sponsors typically build a flagship platform company and then do “buy-and-build” rollups.

1. Pitchbook

Strategic Buyers

Strategic buyers often favor partnerships such as joint ventures (JVs). Across the sector, provider-hospital joint ventures are surging to expand.

Acadia alone launched multiple JVs in 2024 (with Ascension and Lifepoint, among others) to co-build inpatient behavioral hospitals.

Platform Enablers

On the platform side, large chain operators and health systems actively pursue growth. Public players like Acadia Healthcare and Lifepoint (with hundreds of facilities) continue buying large assets.

In March 2024, HCAP Partners created PAX Health by acquiring Behavioral Medicine Associates, Workers Compensation Psychological Network, and Reservoir Health.

A majority of recent M&A activity involves the purchase of smaller practices as part of existing roll-up strategies. Strategic buyers either absorb practices into system-wide networks or form joint ventures, depending on local needs and capital costs. Sellers should note: Joining a large platform may command higher multiples (often 6.0x–13.0x EBITDA for strong assets), whereas a tuck-in may trade at slightly lower multiples but carry less integration risk.

Behavioral health continues to be one of the most compelling subsectors in healthcare M&A, fueled by strong demand fundamentals, payer focus on mental health parity, and investor appetite for scalable, multi-site platforms.

Merritt Perspective: We expect valuation multiples in behavioral health to remain resilient through 2026, supported by favorable reimbursement trends in select sub-specialties such as adolescent care and telepsychiatry. However, smaller single-site groups may face greater pressure on pricing, which can be alleviated through co-marketing (see our white paper on co-marketing).

What Sellers Should Prioritize Today?

Operational Excellence

Ensure clean financial statements, robust compliance infrastructure, and standardized processes—elements that can add 0.5–1.0x to EBITDA multiples.

Proof of Scalability

Showcase a documented growth plan, including de novo expansion and provider recruitment strategies.

Payer Strategy

Highlight strong commercial payer relationships and proactive contracting capabilities to protect margins.

Cultural & Strategic Fit

Evaluate buyers not solely on headline price, but on cultural alignment, governance structure, and post-transaction decision-making rights.

Why Acting Now Matters?

How Timing Impacts Valuation and Partner Selection

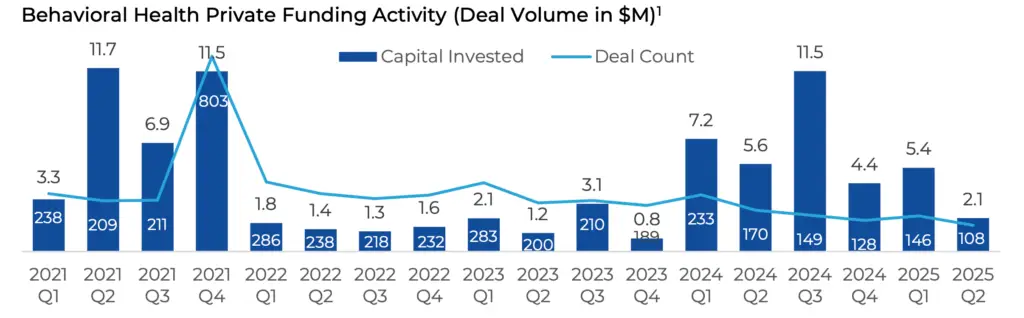

After the pandemic-era boom, behavioral health valuations peaked in 2021–2022. Now, high interest rates and cautious capital markets mean multiples are plateauing.

After the 2023 Change Healthcare hack, for instance, many small practices found themselves in “a difficult cash position”. Providers nearing retirement face a trade-off: hold out for a potentially higher exit multiple (possibly via an equity rollover) or exit now with more cash certainty.

In short, timing and deal structure jointly determine the true value that independent groups realize. Acting during a window of strong demand can maximize valuation but choosing a buyer that offers the right blend of up-front cash and long-term support is equally strategic.

Case Study

A multi-site behavioral health group with 15 providers was facing rising labor costs and increasing administrative complexity. The founders were seeking a strategic partner who could provide both liquidity and long-term growth opportunities without undermining physician compensation.

EBPC Model: Provided 7.5x upfront multiple with 30% equity rollover into the platform. Over three years, platform growth increased the rolled equity value by 2.5x, resulting in higher total proceeds than the traditional sale.

Outcome

- By selecting the EBPC model, the founders achieved a balanced outcome:

- Immediate liquidity through the upfront payment

- Preservation of physician compensation, avoiding reductions that often accompany other transaction models

- Active role in operations, maintaining input into clinical and strategic decision-making

Merritt’s Proven Approach to Maximizing Value

Merritt Healthcare Advisors is a market leader in behavioral health transactions. We identify the right partners, structure deals that protect culture, and maximize value. Our team guides clients from preparation to execution, delivering immediate returns and long-term growth.

- Industry Specialization: Merritt has partnered with numerous specialty groups and practices, working exclusively with physicians, healthcare entrepreneurs, and business owners to deliver high-impact transactions.

- Extensive Network: Our leadership has decades of experience with healthcare organizations, hospitals, national strategics, private equity, and industry leaders nationwide.

- Operational Expertise: We have developed and operated over 30 ASCs, partnering with more than 500 providers to improve performance and profitability.

- Exceptional Results: Merritt delivers measurable, market-leading outcomes. We consistently secure superior financial and strategic results for our clients. Our expertise and insight allow us to manage this complex process efficiently, freeing you to focus on your practice.

With $6.0B in closed transactions, Merritt delivers results that enhance both financial outcomes and operational strength.

Contact Us

John Carron

Partner

jcarron@merrittadvisory.com

(917) 647-8218

Chris Carlesi

Partner

ccarlesi@merrittadvisory.com

(914) 450-9675

Connecticut Office: 63 Copps Hill, 22A Ridgefield, CT 06877

West Coast Office 521 Bachman Ave Los Gatos, CA 95030

(914) 556-6266

merrittadvisory.com

*Registered Investment Banking Agent with Series 79 and 63 licenses. Securities offered through Burch & Company, Inc. Merritt Healthcare and Burch & Company, Inc. (4151 N. Mulberry Drive, Suite 235, Kansas City, MO 64116) are not affiliated entities.

Healthcare Investment Banking

Why Work With Us

MHA is an Industry Leading Healthcare Advisory Firm With an entrepreneurial spirit

As a leading Healthcare Investment Banking firm, we empower owners in healthcare, pharmaceutical, life science, biotech, and medical product sectors to discover new opportunities—whether through growth by acquisition, strategic partnerships, or a successful exit.

With over $6 billion in client transactions, MHA drives profitability and real-world operational improvements.

About Merritt Healthcare Advisors

Merritt Healthcare Advisors (“MHA”) is focused exclusively on representing owners of middle-market healthcare businesses that are considering strategic options, whether it is selling an interest in their organization, creating a new partnership, or growing through acquisition. MHA is unique in that we are the only firm that combines an investment banking background with actual “owners” experience that comes from developing and managing our own healthcare facilities. We have used this experience to successfully complete more than $5 billion in transactions on behalf of our Clients. As the industry’s leading Mergers and Acquisitions (“M&A”) firm, our proven process and extensive buyer network enable us to help our Clients realize the absolute best financial and non-financial outcomes. The Principals of Merritt acted in their capacity of licensed investment banking agents of Burch & Company, Inc., member FINRA/SIPC. For additional information about Merritt Healthcare Advisors, please visit www. merrittadvisory.com

Contact Merritt

John Carron – Partner

jcarron@merrittadvisory.com

(917) 647-8218

Zak Eisenberg – Vice President

zeisenberg@merrittadvisory.com

(914) 815-5479

Connecticut Office

63 Copps Hill, 22A Ridgefield,

CT 06877

(914) 556-6266

West Coast Office

521 Bachman Ave

Los Gatos, CA 95030

merrittadvisory.com

*Registered Investment Banking Agent with Series 79 and 63 licenses. Securities offered through Burch & Company, Inc. Merritt Healthcare and Burch & Company, Inc. (4151 N. Mulberry Drive, Suite 235, Kansas City, MO 64116) are not affiliated entities.